Prepayment penalties. You could run into a lender that costs a penalty in order to pay back your loan off early. Prepayment penalties are generally such as Anything you might have paid in interest should you paid from the loan In keeping with your term.

How often you move. Shifting a number of occasions over the past 5 years could also sign instability in your individual daily life — particularly if you’re relocating across states.

However, compound interest is extremely regarding for borrowers particularly if their accrued compound interest is capitalized into their fantastic principal. This means the borrower's month-to-month payment will truly improve as a result of now having a greater loan than what they started out with.

Choose the compounding frequency, which would be the timing of capitalization from the interest (the unpaid volume of interest added to your loan's principal stability).

Forbes Advisor adheres to strict editorial integrity requirements. To the very best of our understanding, all written content is accurate as of your date posted, nevertheless offers contained herein may well not be available.

Principal: Definition in Loans, Bonds, Investments, and Transactions Principal is the money lent to some borrower or put into an investment. It also can seek advice from A non-public corporation’s operator or maybe the Main participant in a very offer.

Within a low-interest-rate surroundings, there are decrease returns on investments As well as in savings accounts, and naturally, a rise in debt which could necessarily mean a lot more of the potential for default when rates go back up.

Ahead of getting out a personal loan to consolidate debt Article source or finance your up coming order, it’s a good idea to run from the benefits and drawbacks. Underneath are the pros and cons of non-public loans you need to be mindful of.

Generate with assurance any time you compare insurance policies carriers and locate the policy that’s ideal for you.

A pupil loan is surely an unsecured loan from either the federal authorities or a private lender. Borrowers should qualify for private student loans. If you do not have a longtime credit heritage, you might not Click for source discover the greatest loan.

The gives that surface Within this desk are from partnerships from which Investopedia gets compensation. This payment may affect how and where by listings seem. Investopedia would not consist of all delivers out there inside the Market.

The greater complex aspect of calculating interest is usually determining the correct interest rate. The interest rate is usually expressed being a proportion and is frequently selected given that the APR.

We value your believe in. Our mission is to provide readers with accurate and impartial information and facts, and Now we have editorial benchmarks set up in order that comes about. Our editors and reporters carefully actuality-Examine editorial information to guarantee the data you’re looking at is accurate.

You may as well look at the loan calculator in reverse. Learn the way Considerably you can borrow depending on a every month payment you could afford with the interest rates that you may well be supplied.

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Brandy Then & Now!

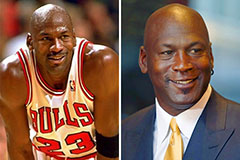

Brandy Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Shane West Then & Now!

Shane West Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!